CHICAGO, Oct. 9, 2017 /PRNewswire/ -- Morningstar, Inc. (NASDAQ: MORN), a leading provider of independent investment research, today released its biennial Global Fund Investor Experience (GFIE) report, which grades the experiences of mutual fund investors in 25 countries across North America, Europe, Asia, and Africa. Morningstar researchers evaluated countries in four categories—Regulation and Taxation, Disclosure, Fees and Expenses, and Sales. The grading scale, updated from 2015's 12-point letter grades, consists of Top, Above Average, Average, Below Average, and Bottom. Researchers identified the United States as the most investor-friendly market, while no country received a Bottom overall grade. More than half of the markets received an overall grade of Average, indicating widespread improvement in investor experiences across multiple markets driven by globalization, stronger regulation, and adoption of best-practice principles.

"The Global Fund Investor Experience report has driven dialogue about global best practices since the report was created in 2009 and continues to evolve in order to meet the needs of today's investor experience," said Anthony Serhan, managing director of research strategy of the Asia Pacific and co-author of the study. "While regulations such as the U.S. Department of Labor Fiduciary Rule and Europe's MiFID II approach implementation, other markets have already acted by enforcing bans on commissions, requiring or encouraging better disclosure from fund companies, and adopting technologies that can lead to lower costs for investors."

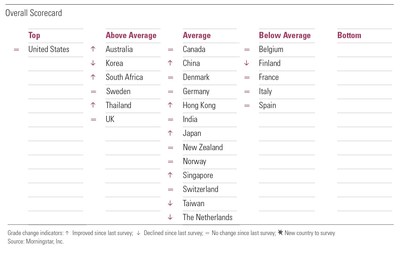

The overall country grades for 2017 are listed here. Highlights of the report include:

- The United States remains the country with the highest grade—as it has since 2009—leading with lower expenses and a strong disclosure regime, but held back by a Regulation and Taxation grade that trails many markets.

- Across the globe, regulation and better practices have improved the environment for mutual fund investors. No country received the "Bottom" overall grade and more than half received an overall grade of Average.

- Notably, India joined the United States in receiving Top grades for Disclosure, and are the only two markets requiring disclosure of remuneration practices for fund managers.

- South Africa, Australia, and Thailand all jumped to Above Average grades off the back of many years of regulatory development.

- France, Italy, Finland, Spain, and Belgium all received Below Average grades, suffering in the areas of Fees and Expenses and Sales. Europe's impending MiFID II regulations will bring in tougher rules to protect investors and should see European markets improve in this study.

- As evidence mounts that fees can be a crucial factor in investment performance, Fees and Expenses are weighted more heavily in 2017 than in previous editions of the report. This year, calculations of asset-weighted median fees in the major asset classes—equity, fixed income, and allocation—show continued downward pressure on fees in many global markets.

- While a number of markets have moved away from paying commissions such as the U.K., Australia, and Netherlands, in 15 markets advisors are still paid predominantly through commissions.

- In 24 out of 25 markets, bank and insurance companies remain one of the most widely available distribution channels. Australia, Canada, New Zealand, and the U.K. are the only markets that feature independent advisors as one of the major distribution channels.

The GFIE report examines the treatment of mutual fund investors from multiple viewpoints: the practices of the fund industry; the practices of fund distributors; the structure and effectiveness of regulatory bodies; disclosure policies; and the tax code. This report considers publicly available, open-end funds—retail registered investment pools that are not listed on an exchange. The section weights used for the overall grade are as follows: Regulation and Taxation, 20 percent; Disclosure, 30 percent; Fees and Expenses, 30 percent; and Sales, 20 percent. The full GFIE report is available here and the methodology is available here.

Morningstar has approximately 130 manager research analysts worldwide who cover approximately 4,420 funds. The company provides data on approximately 223,000 open-end mutual funds, 11,000 closed-end funds, and 14,500 exchange-traded product listings as of June 30, 2017.

About Morningstar, Inc.

Morningstar, Inc. is a leading provider of independent investment research in North America, Europe, Australia, and Asia. The company offers an extensive line of products and services for individual investors, financial advisors, asset managers, retirement plan providers and sponsors, and institutional investors in the private capital markets. Morningstar provides data and research insights on a wide range of investment offerings, including managed investment products, publicly listed companies, private capital markets, and real-time global market data. Morningstar also offers investment management services through its investment advisory subsidiaries, with more than $200 billion in assets under advisement and management as of June 30, 2017. The company has operations in 27 countries.

Morningstar's Manager Research Group consists of various wholly owned subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research Services LLC. The grades assigned for each country are derived from a qualitative assessment process performed by manager research analysts. The grades referenced in this release and report are assessments, thus are statements of opinions and are not to be considered as guarantees. This press release and the Global Fund Investor Experience report is for informational purposes only.

©2017 Morningstar, Inc. All Rights Reserved.