iShares STOXX Europe 600 Industrial Goods & Services UCITS ETF (DE) | EXH4Registrer dig for at låse op for ratings |

| Fondens performance | 31-03-2024 |

| Vækst af 1.000 (DKK) | Avanceret graf |

| Fond | 5,2 | 27,0 | -18,8 | 23,6 | 11,3 | |

| +/-Kat | -1,0 | 0,5 | -9,5 | 8,2 | 4,0 | |

| +/-Indeks | - | 3,0 | -13,3 | 14,5 | 8,2 | |

| Kategori: Sektor - Industrivarer, Aktier | ||||||

| Kategoribenchmark: Morningstar Global Bas Mat ... | ||||||

| Oversigt | ||

| Closing Price 26-04-2024 | EUR 84,49 | |

| Kursændring 1 dag | 1,72% | |

| Bud (26-04-2024) | EUR 83,55 | |

| Udbud (26-04-2024) | EUR 86,08 | |

| Morningstar Kategori™ | Sektor - Industrivarer, Aktier | |

| Omsætning | 14877 | |

| Børs | DEUTSCHER KASSENVEREIN AG GRUPPE DEUTSCHE BOERSE | |

| ISIN | DE000A0H08J9 | |

| Markedsværdi i alt (mio.) 26-04-2024 | EUR 202,12 | |

| Seneste TNA(mio.) 26-04-2024 | EUR 202,12 | |

| Løbende omkostning 28-12-2023 | 0,46% | |

| Investeringsstrategi | Passiv | |

| Investeringsmålsætning: iShares STOXX Europe 600 Industrial Goods & Services UCITS ETF (DE) | EXH4 |

| iShares STOXX Europe 600 Industrial Goods & Services (DE) is an exchange traded fund (ETF) that aims to track the performance of the STOXX® Europe 600 Industrial Goods & Service Index as closely as possible. The ETF invests in physical index securities. The STOXX® Europe 600 Industrial Goods & Service Index offers exposure to the European Industrial Goods & Services sector as defined by the Industry Classification Benchmark (ICB). It is a sub index of the STOXX® Europe 600 Index. The STOXX® Europe 600 Index offers exposure to large, mid and small capitalisation stocks from European developed countries. The index is free float market capitalisation weighted. iShares ETFs are funds managed by BlackRock. They are transparent, cost-efficient, liquid vehicles that trade on stock exchanges like normal securities. iShares ETFs offer flexible and easy access to a wide range of markets and asset classes. |

| Returns | ||||||||||||||||

|

| Management | ||

Manager navn Startdato | ||

Ikke oplyst af foreningen 08-07-2002 | ||

Startdato 08-07-2002 | ||

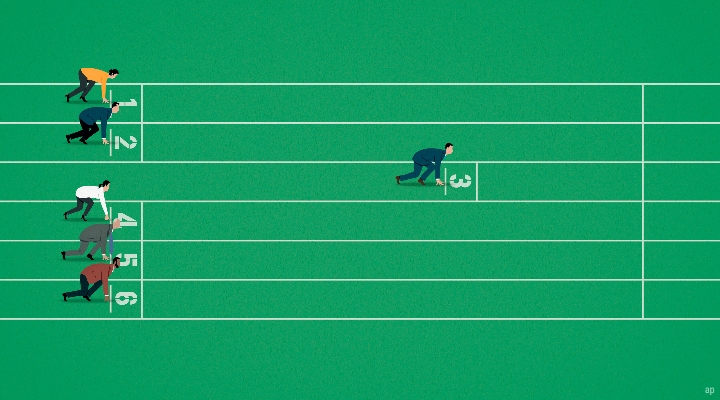

| Annonce |

| Kategoribenchmark | |

| Fondens indeks | Morningstar indeks |

| STOXX Europe 600 Indl Gd&Svcs NR EUR | Morningstar Global Bas Mat TME NR USD |

| Target Market | ||||||||||||||||||||

| ||||||||||||||||||||

| Formuefordeling iShares STOXX Europe 600 Industrial Goods & Services UCITS ETF (DE) | EXH4 | 25-04-2024 |

| |||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||

| Top 5 placeringer | Sektor | % |

Siemens AG Siemens AG |  Industri Industri | 8,94 |

Schneider Electric SE Schneider Electric SE |  Industri Industri | 8,32 |

Airbus SE Airbus SE |  Industri Industri | 6,38 |

Safran SA Safran SA |  Industri Industri | 5,40 |

ABB Ltd ABB Ltd |  Industri Industri | 5,05 |

Øget Øget  Mindsket Mindsket  Ny siden sidste portefølje Ny siden sidste portefølje | ||

| iShares STOXX Europe 600 Industrial Goods & Services UCITS ETF (DE) | EXH4 | ||